At Evergreen Home Loans®, we know that saving up for a home can feel overwhelming—especially if you’re still holding onto the idea that you need 20% down. The good news? That’s one of the most common myths in homebuying.

Let’s break it down.

Do You Really Need 20% Down?

Unless a specific loan program or situation requires it, most buyers don’t need to put 20% down. In fact, there are several financing options designed to help first-time homebuyers get into a home with much less.

At Evergreen, we offer loan programs like:

- FHA loans with as little as 3.5% down

- VA and USDA loans with zero down for qualified borrowers

- Conventional loans that may offer down payments as low as 3%

While a larger down payment can reduce your monthly payment and avoid mortgage insurance, it’s far from the only path to homeownership.

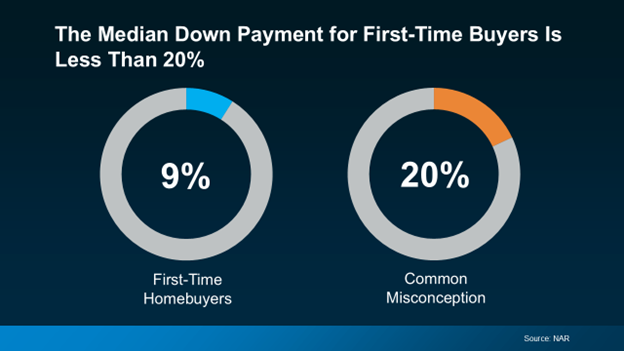

According to the National Association of Realtors®, the typical first-time homebuyer puts down just 9%. That’s a big difference from the 20% many people assume they need.

Don’t Overlook Down Payment Assistance (DPA) Programs

Here's where things get even more exciting: many first-time buyers qualify for down payment assistance but never tap into it. In fact, nearly 80% of buyers qualify, yet only 13% actually use these resources.

That’s a lot of missed opportunity.

The average DPA benefit? Around $17,000—a serious boost toward your down payment and upfront homebuying costs.

At Evergreen, we help you explore these programs and even look at options to stack multiple assistance programs if you qualify. That way, your savings can stretch even further.

The Evergreen Advantage

Saving up doesn’t have to slow you down. With loan options that work for real budgets and programs to support your goals, our team is here to help you move forward with confidence.

You may not need to save as much as you thought to buy a home. Let’s talk about your options, explore down payment assistance, and build a plan that gets you into a home sooner—not someday.

.svg)