When’s the last time you checked the value of your home? (We’ll wait.)

If it’s been a while, you’re not alone—but it might be time to take another look. At Evergreen Home Loans®, we believe homeownership isn’t just about where you live—it’s also a powerful way to build wealth. And one of the most overlooked tools in your financial toolbox? Home equity.

What Is Home Equity?

Home equity is the difference between your home’s current market value and what you still owe on your mortgage. If your home is worth $500,000 and you owe $200,000, your equity is $300,000. That’s real money—real opportunity—just sitting there.

According to Cotality (formerly CoreLogic), the average U.S. homeowner with a mortgage has roughly $311,000 in equity. That's a big number, and chances are, your home’s value has quietly grown while you’ve been living your life.

Why You May Have More Equity Than You Think

Here are two big reasons homeowners like you may be sitting on more equity than expected:

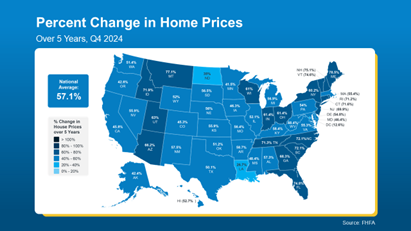

- Home Prices Have Risen Sharply.

Over the past five years, home prices have increased more than 57% nationwide, according to the Federal Housing Finance Agency (FHFA). If you purchased your home a few years ago, it’s likely worth far more today—especially in many of the markets Evergreen serves.

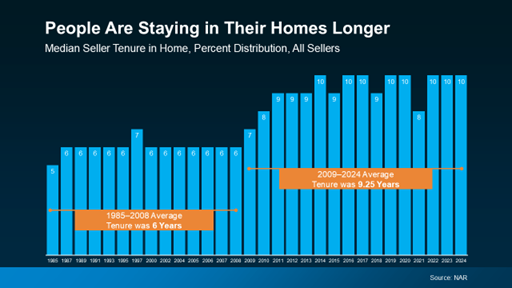

- Homeowners Are Staying Put Longer.

The National Association of Realtors (NAR) says the average homeowner now stays in their home for about 10 years. That means a decade of mortgage payments plus a decade of appreciation—equity has been building in the background the whole time.

In fact, NAR reports that over the past 10 years, the typical homeowner has gained over $200,000 in wealth just from price appreciation.

What Can You Do with That Equity?

This is where it gets exciting. At Evergreen, we help homeowners like you turn equity into opportunity every day:

- Buy your next home with confidence. Your equity could help fund your down payment or, in some cases, allow you to make a cash offer with programs like CashUp™ or buy before you sell with StepUp™.

- Renovate your current home. Need more space? Want to upgrade your kitchen or build a backyard oasis? A cash-out refinance could turn your equity into the funds to do it right.

- Start that business you’ve been dreaming of. With smart planning, your equity can help you invest in your future earning potential.

Let’s Explore Your Equity Potential

Whether you're planning a move, exploring upgrades, or just want to understand your options, we’re here to help. Our team at Evergreen Home Loans® is happy to review your current situation and walk you through what’s possible.

Your home might be worth more than you think—and that value can unlock real possibilities.

Let’s talk. Reach out to your local Evergreen Loan Officer to get started.

Source: KCM

.svg)