Today’s housing market is undeniably different from what it was throughout 2021 and early 2022. Increased interest rates and homes sitting on the market for longer periods of time have replaced historically low interest rates and a hot market characterized by bidding frenzies. Whether you’re currently a homebuyer, home seller, or both, you may wonder what this means for you. It could mean that now’s a great time to take advantage of a 2-1 seller-paid buydown.

Buydown basics

What exactly is a buydown? It’s when points—commonly referred to as discount points, mortgage points, or prepaid interest—are used to buy down a loan’s interest rate as a one-time upfront fee. The value of one point equals one percent of the principal (original loan amount), meaning that one point on a $100,000 loan would equal $1,000. While that’s a consistent value across lenders, the amount that one point will reduce a loan’s interest rate can vary between lenders and is dependent on additional factors such as the loan type and current rates. It’s also important to note that there might be buydown maximums.

Then, there are different ways for the cost of a buydown to be paid, including borrower-paid and seller-paid. Just as they sound, borrowers cover the cost with a borrower-paid buydown, and sellers cover the cost with a seller-paid buydown.

The party responsible for payment isn’t the only thing that can differ—different buydown types are available. They can be permanent or temporary and apply to fixed-rate and adjustable-rate mortgages. With a permanent buydown, the interest rate gets bought down for the full loan term. In comparison, the interest rate gets bought down for specific years of the loan term with a temporary buydown. A 2-1 buydown is a common temporary program.

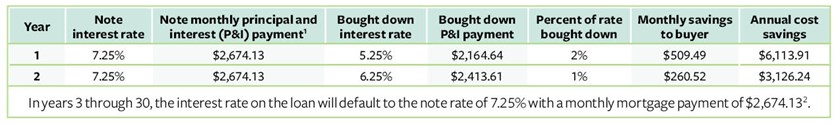

Securing a mortgage with a 2-1 buydown allows for the interest rate to be reduced during the first two years of the loan term before rising to the permanent rate, also known as the note rate, in year three. The interest rate is often reduced by 2% in the first year, followed by 1% in the second year.

2-1 buydown example

Here’s a 2-1 buydown example for a 30-year fixed-rate loan term where the points cost $9,240.15:

Potential benefits of a 2-1 seller-paid buydown

Now that we’ve covered some buydown basics and reviewed an example, let’s take a closer look at how a 2-1 seller-paid buydown could be beneficial in a real estate transaction today.

For buyers, a 2-1 seller-paid buydown helps them ease into homeownership. Initial monthly payments are below their permanent monthly payment, making the mortgage more affordable upfront. And as a result, they pay less interest over the life of the loan, compared to a loan without a buydown that has the same note interest rate and principal. A 2-1 seller-paid buydown is generally a safe way buyers can take advantage of temporarily securing a lower interest rate and monthly payment in a rising rate environment.

Sellers could benefit from a 2-1 buydown, too. Offering one on their home listing might make it more attractive to buyers and help it stand out against other listings, especially when interest rate hikes are a reality. Or, if a buyer requests for a seller to offer one and the seller accommodates the request, the buyer could be more likely to purchase the home. Many homes are sitting on the market for an extended period of time, and a 2-1 seller-paid buydown may be a great home-selling strategy.

Overall, a 2-1 seller-paid buydown could be a win-win for both homebuyers and home sellers. If you’re interested in learning more about taking advantage of this powerful tool, connect with an Evergreen loan officer today. We also offer 1-0 and 3-2-1 buydowns. One of our home loan experts can help explain the ins-and-outs so that you’re well-informed and set up for success on your homeownership journey.

Rates are as of 10/19/2022 and subject to change without notice, certain conditions apply. Not all customers will qualify for the terms noted. 1. Monthly payment is principal and interest (P&I) only, based on purchase price of $490,000 with a loan amount of $392,000, 7.25% fixed rate, 30-year term, APR 7.551%, and 20% down payment. 2. Payment does not include taxes and insurance premiums. The actual payment amount will be greater. Some state and county maximum loan amount restrictions may apply. The payment scenario is for example purposes only. Ask for current rates. Not all products available. Program is subject to change.

.svg)