Are you contemplating the age-old question of whether to rent or buy a home this year? Let Evergreen Home Loans provide you with a crucial insight to help guide your decision with clarity and confidence.

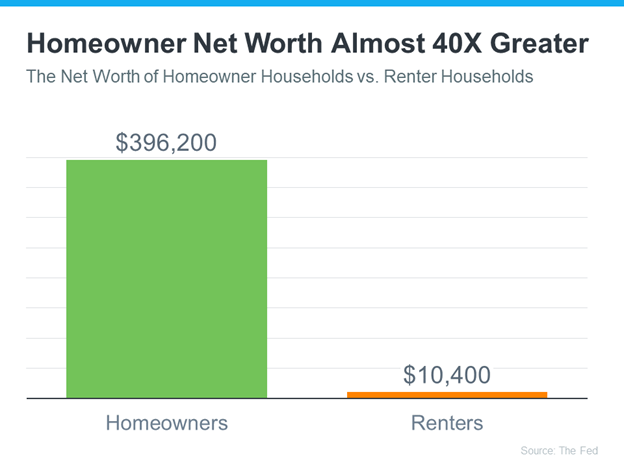

Every three years, the Federal Reserve's Survey of Consumer Finances (SCF) reveals eye-opening differences in net worth between homeowners and renters. The latest report indicates that the average homeowner’s net worth is almost 40 times greater than that of a renter. This substantial wealth gap is primarily due to the equity homeowners build as their property appreciates and through consistent mortgage payments.

The Power of Home Equity in Wealth Building

Home equity is a significant wealth builder for many households, often surpassing other assets in contributing to an individual's net worth. This trend spans across various income levels. Homeownership is not just about having a place to live; it's a robust financial strategy that fosters stability and wealth preservation across generations.

At Evergreen Home Loans, we understand that the journey to homeownership is a critical step in wealth building. Our innovative loan products are designed to make this path accessible and rewarding, especially for first-time buyers.

Evergreen’s Innovative Solutions to Homeownership

We offer tailored mortgage solutions to fit diverse financial situations, helping more people transition from renting to owning.

Our CashUp Suite of Products are designed to give buyers a competitive edge in the housing market, enhancing their purchasing power.

For those looking to build their dream home, our Construction Loans offer the flexibility and support needed to turn visions into reality.

Navigating the Current Real Estate Market with Evergreen

With fluctuating mortgage rates and a changing inventory landscape, navigating the real estate market can be challenging. This is where Evergreen Home Loans steps in. Our team of dedicated mortgage advisors will guide you through the opportunities available in today's market, ensuring you find the perfect home to start building your wealth.

Conclusion: The Evergreen Advantage

Owning a home is more than just a lifestyle choice; it's a key to unlocking your financial future. With Evergreen Home Loans, embark on this journey with confidence. Our innovative products and personalized service are here to help you increase your wealth through homeownership, regardless of your income level.

To learn more about how we can assist in transforming your homeownership dreams into a wealth-building reality, connect with your local Evergreen Lender.

Source: Keeping Current Matters

.svg)