If you’ve been keeping an eye on the housing market, you’ve probably noticed a few shifts already this year. But what’s next? From home prices to mortgage rates, here’s what the latest expert forecasts suggest for the remainder of 2025 – and what that could mean for your next move.

Will Home Prices Drop?

Many hopeful buyers are still waiting for a big drop in home prices. And with headlines reporting small price dips in certain areas, it’s easy to think a larger correction is just around the corner.

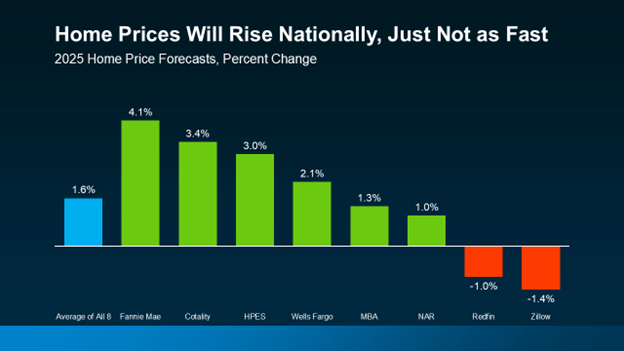

But here’s what the experts are actually saying:

While price growth is slowing, it doesn’t mean a crash is coming. As the National Association of Home Builders (NAHB) explains:

“House price growth slowed . . . partly due to a decline in demand and an increase in supply. Persistent high mortgage rates and increased inventory combined to ease upward pressure on house prices. These factors signaled a cooling market, following rapid gains seen in previous years.”

So, what does this mean for you? Nationally, prices are still expected to rise—just at a slower pace. The average projection from eight leading industry forecasters suggests home values will increase 1.5–2% in 2025.

And while some markets are seeing small decreases, they’re minor—about -3.5% on average. That’s nothing like the 20% drop we saw during the 2008 housing crisis. Plus, with home prices up 55% nationally over the past five years (according to the Federal Housing Finance Agency), small fluctuations are natural.

The bottom line: Home values are expected to continue climbing, just not as rapidly. Working with a local expert can help you understand exactly what’s happening in your market.

Will Mortgage Rates Come Down?

Another big question: should I wait for rates to drop?

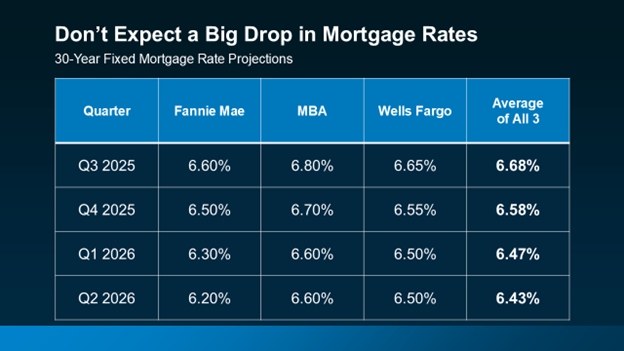

Here’s the reality: current projections suggest mortgage rates will remain fairly steady, likely ending the year in the mid-6% range. As Yahoo Finance recently reported:

“If you’re looking for a substantial interest rate drop in 2025, you’ll likely be left waiting.”

That’s why trying to time the market often isn’t the best strategy. If you’re ready to move or need to move, it's more important to create a plan that works with today’s rates than to wait for a drop that may not come.

At Evergreen Home Loans™, our loan officers understand the economic factors influencing rates, and they’ll help you explore all your options. Whether that’s using one of our innovative loan programs, buying down your rate, or getting pre-approved so you’re ready when the right home hits the market, we’ve got you covered.

What This Means for Buyers and Sellers

Whether you’re buying, selling, or doing both, this market is all about strategy. Home prices are still rising nationally, and rates are holding steady. That means now could be the right time to move, especially if you have a clear plan and the right team by your side.

Let’s Build a Plan That Works for You

At Evergreen Home Loans™, we believe your homebuying journey should be driven by your goals, not the headlines. Let’s connect and talk about what’s happening in your local market so we can help you move forward with confidence.

Ready to get started? Contact your local Evergreen loan officer today.

Source: KCM

.svg)