After years of rapid changes in the housing market, it’s no surprise that homeowners and buyers have questions. Understanding the current trends, and what they mean for your next move, can help you make confident decisions.

Here are the three questions we hear most often, with clear answers backed by the latest data.

1. “Will I Be Able to Find a Home?”

The short answer: yes, more so than in recent years.

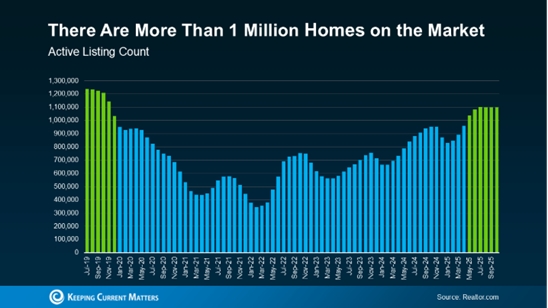

Inventory has steadily improved. According to Realtor.com, there have been more than one million homes for sale nationally for six consecutive months, something we haven’t seen since 2019.

What this means for you:

- Buyers: More homes to choose from, less competition, and time to make thoughtful decisions.

- Sellers: Greater flexibility when planning your next move.

Homes aren’t disappearing the moment they hit the market anymore. Buyers can now compare options, ask questions, and move at a more deliberate pace.

Tip: Our Security Plus Seller Guarantee™ can help your offer stand out by reducing uncertainty for sellers—giving you an edge without overpaying.

2. “Will I Ever Be Able to Afford a Home?”

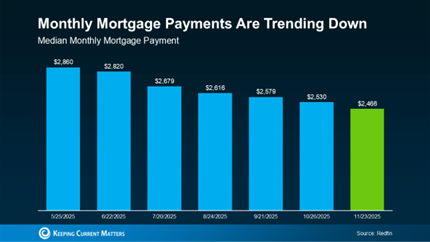

Affordability is improving thanks to two key shifts:

- Mortgage rates trending lower

- Home price growth moderating

These factors mean monthly payments are lower than just a few months ago, making homeownership more attainable for many buyers.

Understanding your options is critical. Rate strategies, local pricing trends, and tailored loan programs can all impact what’s possible. At Evergreen Home Loans™, we guide buyers through the numbers so they can move forward with confidence, knowing they have a plan that fits their goals.

3. “Should I Wait for Prices to Come Down?”

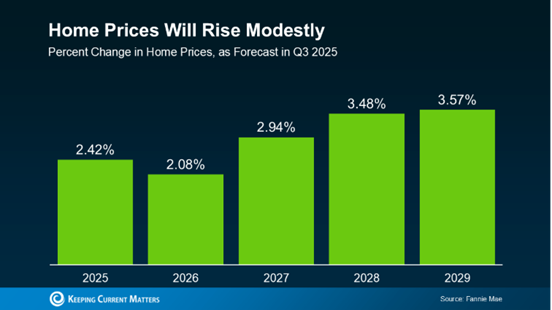

It’s natural to wonder if waiting will save money—but the housing market is complex and local:

- Some markets are leveling off, others continue to appreciate.

- Nationally, experts surveyed by Fannie Mae expect home prices to keep rising, albeit at a slower, more sustainable pace.

- Current homeowners hold significant equity, making the market much stronger than during the last housing crash.

History shows that long-term wealth comes from time in the market, not perfect timing. Waiting for a dramatic drop can mean missing opportunities.

The housing market can feel overwhelming with so much information out there. The key is understanding how current data applies to your situation and your local market.

With programs like Security Plus and guidance from a trusted loan officer at Evergreen Home Loans™, you can explore your options, evaluate what makes sense, and plan your next move confidently—whether that’s buying now, selling, or simply preparing for the future.

Next Step: Connect with a local loan officer today to discuss your goals and see what’s possible in your market.

Source: KCM

.svg)