You’ve likely heard recent news about rising interest rates. Whether it’s your credit card interest payment, or the cost to finance a home, the cost to borrow money has been increasing. However, while there is no doubt that interest rates are higher than they have been in the past two years, it is important to look at rising interest rates from a broader, more historical point of view.

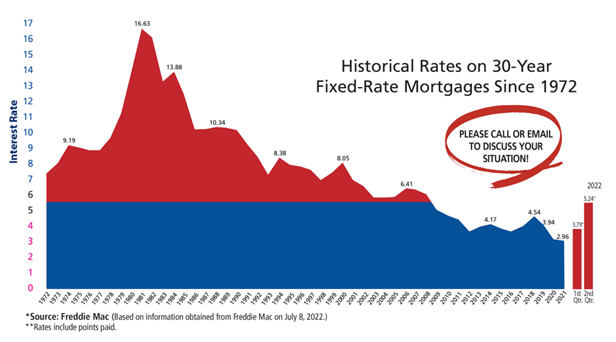

Mortgage backed securities giant, Freddie Mac has collected and published data on average weekly mortgage interest rates since the early 1970s. With nearly 50 years of data, this snapshot of the rise and fall of mortgage interest rates provides a powerful snapshot of how rates have fluctuated. The biggest take away when you look at rates over the last nearly half-century? Rates are still historically low.

A look to the past

Over the course of the last 49 years, the average interest rate has typically hovered above 5%. Freddie Mac recorded the highest interest rate at 16.63 in 1981. Since then, interest rates have been on a downward slope, with periodic spikes. It wasn’t until the burst of the housing bubble in the mid-2000s, and the subsequent recession, that we saw interest rates fall below 5%. Since then, we have seen interest rates hover at unprecedented lows. As the economy recovered, the Federal Reserve slowly began inching interest rates higher. By 2019, interest rates were ticking closer to the 5% range. However, with the onset of the pandemic, interest rates dramatically dropped again, leading to the extremely low interest rates we experienced through 2020 and 2021.

Where we are now

Over the past few months, we have all felt the impacts of inflation. Prices have increased and whether it’s the total of our weekly groceries to a tank of gas, many goods and services cost more, including the cost to borrow money. However, it is important to keep in mind, that while it may be more expensive to finance a mortgage than it was a year ago, rates are still very low when compared to the historic average. Homebuyers may still have the opportunity to purchase a home at an affordable rate and start building equity.

Mortgage solutions for a rising rate environment

In a rising interest rate environment, many homebuyers may look for financing solutions designed to help increase their buying power and ensure they secure the lowest rate available to them. At Evergreen Home Loans™ we offer a range of products that are well suited to meet this goal. We’ll work with you to understand your home financing needs and provide you with mortgage solutions that are tailored to you. With a selection of adjustable-rate mortgages and a suite of innovative products, we are well equipped to help you leverage your buying power and help you secure an affordable interest rate. If you’d like to see what loan options are available to you, reach out to one of our knowledgeable loan officers today to learn more.

.svg)