If you’re like many homeowners, you probably don’t want to give up your low mortgage rate. That’s understandable. But here’s the reality, a 3% rate can’t fix a home that no longer works for you. When life changes, your housing needs often change with it. That’s where having the right loan officer matters.

At Evergreen Home Loans™, we see this every day. Homeowners aren’t moving just for something new—they’re moving because their current home no longer supports their family, career, or long-term goals. The goal isn’t to chase a rate, it’s to create a path forward that makes sense financially and personally.

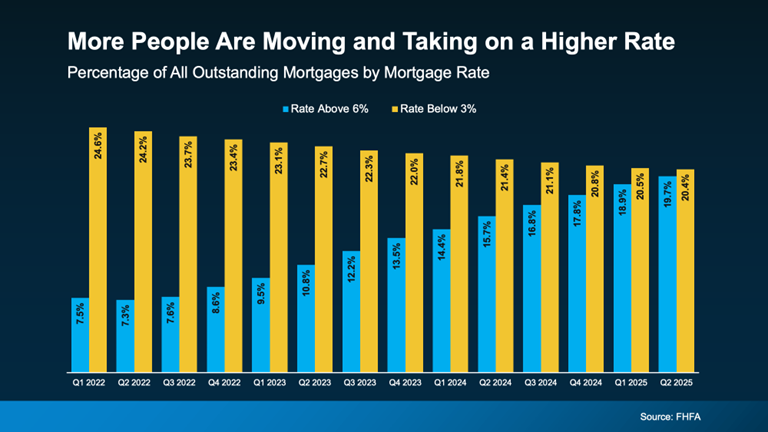

The Lock-In Effect Is Easing

For years, the “lock-in effect” kept homeowners rooted in their current homes. Many stayed put to avoid a higher rate, even if their house no longer worked for them. However, recent data from the Federal Housing Finance Agency (FHFA) shows that this effect is gradually loosening.

- The number of homeowners with rates below 3% is slowly declining.

- More buyers are now taking on rates above 6%.

With thoughtful planning and flexible solutions like Evergreen’s StepUp program, which can help homebuyers purchase a new home before selling their current one, moving forward is becoming more achievable. More homeowners are accepting today’s rates as the new normal and choosing to move ahead with their life plans.

The Life Changes That Are Outweighing Low Mortgage Rates

According to First American, these “5 Ds” often create the need for a new home:

- Diplomas: Career advancement and increased income can boost buying power, making a move to a different home a natural next step.

- Diapers: As families grow, a home that once worked may no longer be the right fit.

- Divorce: Major life transitions often create the need for a fresh start.

- Downsizing: When children move out, homeowners often seek a smaller, more manageable home.

- Death: The loss of a loved one can shift priorities, including the desire to be closer to family or support systems.

Whatever the reason, the key takeaway is clear. For many homeowners, holding onto a low rate isn’t worth putting life on pause.

Making Your Move Easier with Evergreen

Life moves fast—and your home should keep up. While a low mortgage rate has been a fantastic advantage, your priorities may be changing. With programs like StepUp and other flexible solutions, Evergreen can help you move confidently, right-size your home, and plan your next chapter.

If you’re ready to explore what’s possible in today’s market, talk with your local Evergreen Loan Officer. Let’s find a solution that works for your next chapter.

Source: KCM

.svg)