Concerns about a potential recession have been a hot topic recently. Many fear that a recession could lead to increased unemployment and, consequently, a surge in foreclosures reminiscent of the situation 15 years ago. However, insights from Evergreen Home Loans, backed by data from renowned sources like the Wall Street Journal's Economic Forecasting Survey, paint a different picture.

The latest survey findings show a shift in economists' perspectives. Less than half (48%) now predict a recession in the upcoming year, marking a notable decrease from previous forecasts. This change in sentiment indicates a growing optimism about the U.S. economy's resilience.

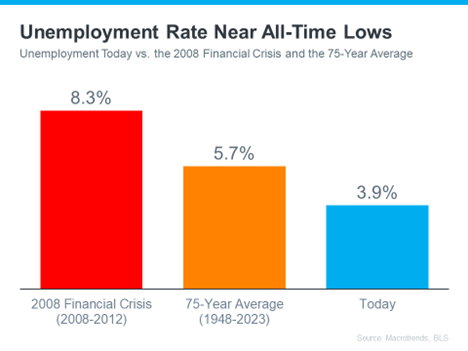

While the threat of job losses can't be entirely dismissed, and any loss is significant for those affected, the broader economic context suggests a stable housing market. Historical data from Macrotrends and the Bureau of Labor Statistics (BLS) reveal that the current unemployment rate remains near all-time lows, well below the average since 1948 (5.7%) and significantly lower than the peak during the 2008 financial crisis (8.3%).

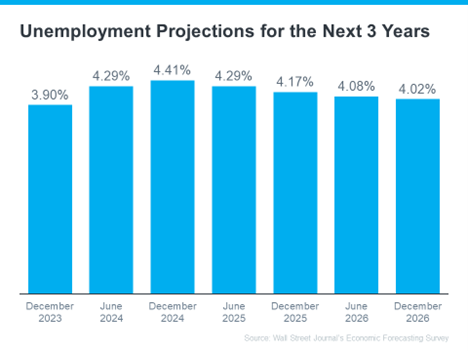

Looking ahead, projections suggest that the unemployment rate will likely stay below the 75-year average. This scenario reduces the likelihood of a foreclosure wave that could destabilize the housing market.

The Evergreen Perspective

At Evergreen Home Loans, we closely monitor these economic indicators to provide you with the most accurate and helpful insights. Most economists are moving away from predicting an immediate recession and do not foresee a dramatic increase in unemployment leading to a housing market crash.

Our commitment is to keep you informed and confident in your housing decisions. If you're concerned about how unemployment might affect the housing market and your home loan options, Evergreen Home Loans is here to help. Connect with your local Evergreen lender to get your homebuying journey started.

.svg)