Understanding the influence of mortgage rates on your home-buying power is key, especially if you're considering a partnership with Evergreen Home Loans. Recently, the rates for 30-year fixed mortgages have seen a significant decrease. This decline is a positive sign for potential homebuyers.

This trend offers a breath of fresh air for buyers. As a recent Bankrate article highlights, this drop in rates somewhat eases the housing affordability squeeze. Further emphasizing this point, Edward Seiler, AVP of Housing Economics and Executive Director of the Research Institute for Housing America at the Mortgage Bankers Association, notes that the MBA anticipates continued improvement in affordability conditions as mortgage rates decline.

The Impact of Mortgage Rates on Your Home Search

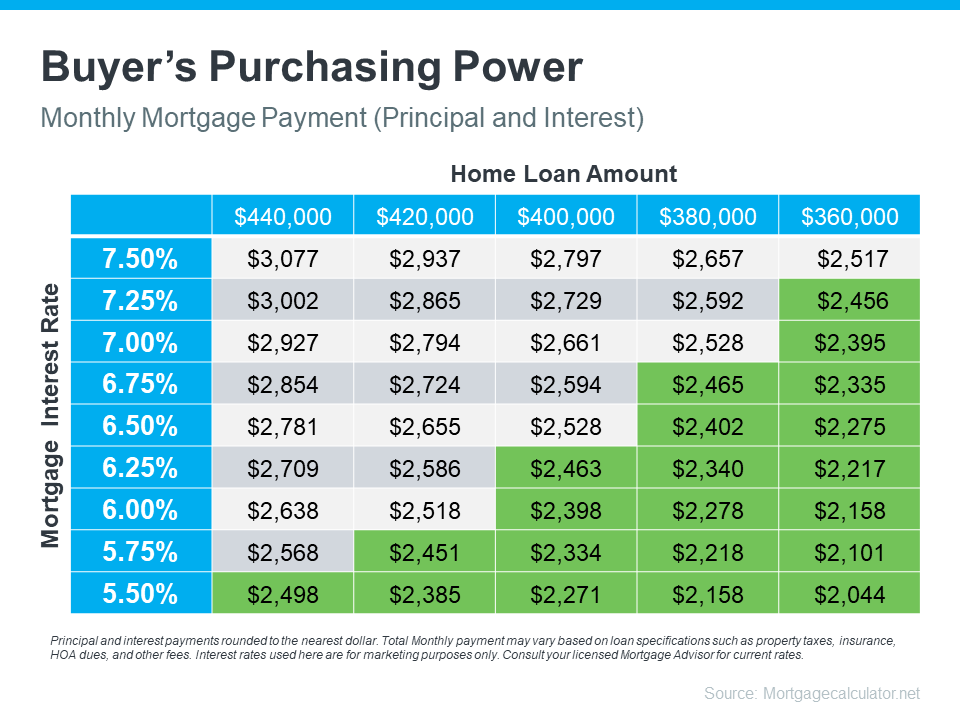

Grasping how mortgage rates affect your monthly home payment is essential in your journey towards homeownership. For instance, if your budget is in the $2,400 to $2,500 monthly payment range, even slight rate fluctuations can significantly influence your budget and the loan amount you can afford.

Seek Guidance from Evergreen Home Loans Experts

When considering a home purchase, it's crucial to consult with knowledgeable professionals. At Evergreen Home Loans, our team is ready to guide you through various mortgage options, helping you understand the factors influencing mortgage rates and how these fluctuations impact your purchasing power.

By examining current data and adjusting your strategy to align with today's rates, you'll be better equipped and confident in your homebuying journey.

For those planning to buy a home, the recent downward trend in mortgage rates is encouraging news. Partner with Evergreen Home Loans, and let's strategically plan your next steps in the homebuying process. Contact your local Evergreen Loan Officer for a free consult today!

Source: Keeping Current Matters

.svg)