In a significant move that impacts both the housing market and home loan institutions like Evergreen Home Loans, the Federal Open Markets Committee (FOMC) has announced the maintenance of its short-term policy interest rate between 5.25% and 5.5%. This decision, announced on Wednesday, marks the fourth time in 2023 that the FOMC has paused rate hikes, following 11 increases since March 2022.

Federal Reserve Chairman Jerome Powell, addressing the current economic climate, indicated an expectation of three 25 basis point reductions in rates during 2024. This strategic shift signals the end of rate hikes and a new phase in monetary policy, potentially bolstering investment confidence.

Responding to this development, the bond market saw a drop in the 10-year Treasury yield to 4.0%, a low since late July. Experts, including Mike Fratantoni from the Mortgage Bankers Association, interpret this as an end to discussions about further rate hikes, focusing instead on the rate reduction pace. This is anticipated to positively affect housing and mortgage markets, potentially leading to lower mortgage rates and spurring modest growth in home sales for 2024.

Evergreen Home Loans, a key player in the mortgage sector, has been closely monitoring these developments. "The Fed's decision aligns with our expectations and bodes well for homebuyers and the overall housing market," states a spokesperson from Evergreen Home Loans. "We foresee an uptick in mortgage activities, including refinancing, as rates become more favorable."

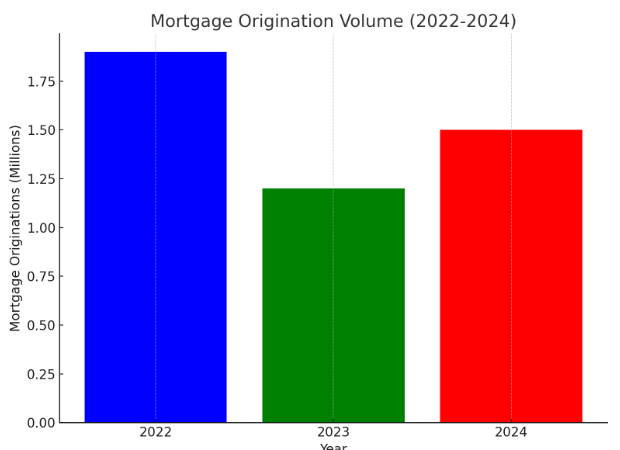

Throughout 2023, the Fed's rate hikes impacted various sectors, with the mortgage industry being particularly affected. TransUnion reports a 37% year-over-year decrease in mortgage originations. Evergreen Home Loans, however, has navigated these challenges by focusing on customer-centric solutions and anticipates a more favorable environment in 2024.

Selma Hepp, chief economist at CoreLogic, notes that despite a strong November jobs report, signs of economic cooling are evident. This includes slower job growth and modest rises in unemployment rates, hinting at a more restrained economic outlook for the next year.

Looking ahead, the anticipation of rate cuts in 2024 brings a positive outlook. The Primary Mortgage Market Survey index by Freddie Mac, which stood just above 7% recently, is expected to decline further, providing relief to rate-sensitive homebuyers.

Evergreen Home Loans echoes the sentiment of Realtor.com Chief Economist Danielle Hale, expecting mortgage rates to drop to around 6.5% by year-end 2024. This decrease would greatly benefit those with existing high-rate mortgages, opening up opportunities for refinancing and greater affordability.

Michele Raneri, VP of U.S. research and consulting at TransUnion, highlights the potential savings for homeowners with a rate drop to 5.5%. This could mean significant monthly savings, freeing up resources in a high cost-of-living environment.

In conclusion, the Fed's steady approach and future rate cuts are seen as a positive development by Evergreen Home Loans and other market players, paving the way for a more vibrant housing market in 2024.

Source: HousingWire

.svg)